does tesla model y qualify for federal tax credit

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Just for fun and assuming there werent a cap a 70 kWh Model S would receive 417 for every kWh exceeding 5 kWh resulting in over 27000 in tax credits.

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

. The federal tax credit topic is common knowledge though I think thats why you are getting down voted. The effective date for this is after December 31 2021. The Tesla Model Y doesnt qualify for the 7500 federal tax credit for electric vehicles because the company has passed the 200000-unit.

EV tax credits jump to 12500 in latest legislation -- with a catch. Electric Vehicles Solar and Energy Storage. All about the Tesla Model Y to complete Teslas S-3-X-Y lineup.

Most likely wont apply to Tesla. Most likely wont apply to Tesla. I saw where EVs should get 2500-7500 tax credit and that is not reflecting in my estimated refund.

Do Teslas not qualify for an EV tax credit. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US.

Its based on manufacturer not model and will be gone by Model Y production. The second document made further changes. So unless something changes it will only be state incentives.

This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax. GM would be the big winner with the updated regulations while Tesla would again receive some federal tax.

The Tesla Model Y doesnt qualify for the 7500 federal tax credit for electric vehicles because the company has passed the 200000-unit. Since the new law would take the tax credits off the price of an EV at the time of purchase Tesla is making moves to get more money upfront from its customers before getting the rest from Uncle Sam. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100.

There is no federal tax credit but you should still enjoy the car. Yes You can finance your Tesla Model X by putting minimal down and still take section 179 or Bonus depreciation on the vehicles. Place an 80000 price cap on eligible EVs.

However Teslas can still qualify for up to 7500 in tax credits. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Create an additional 2500 credit for assembled in the US.

Ad Plug in and Turn Heads in the All-New Blazer EV. Tesla reached this mark in July of 2018 so the 50 credit phase out began in January 2019 and ran through the end of June 2019. For example if you are purchasing your Tesla Model X for 100000 you can put 20000 down payment finance remaining 80000over 5 years yet still claim 100000 in tax deduction using section 179 and Bonus Depreciation.

Please check out the latest TMC Podcast 13 where we discussed new Model Y launches Tesla improving service nationwide EV charging expansion. All about the Tesla. A 90 kWh Tesla would receive an.

Electrek noticed that Tesla has increased the price of the Model Y by 1000. First here are some Tesla vehicles that will qualify for the Tax Credit. Wording says rebate will apply to vehicles.

Snow Drift Off-Road Assist Activated Feb 10 2016 2010 1618 Long Island. 11thIndian Member Jan 3 2017 359 279 San Jose CA May 17 2019 3 The Federal Tax credit will have run out by the end of this year. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

EV tax credit increase to 12500 makes the cut in Bidens Build Back Better framework. The Tesla Team 10 août 2018 Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit. I bought the model 3 in 2018 so it doesnt qualify for for the new rules.

Tax Credit Model Y. Tesla Model Y 179 Deduction. Create an additional 2500 credit for union-made EV.

Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service. So based on the date of your purchase TurboTax is correct stating that the credit is not available for your vehicle. The All-Electric Midsize Blazer EV SUV Will be Available in a Power-Boosting SS Trim.

Tesla and General Motors are the only manufacturers that have reached the 200000-car milestone meaning new purchases of qualifying vehicles from these manufacturers are not eligible for the electronic car tax credit. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100. Local and Utility Incentives.

A refundable tax credit is not a point of purchase rebate. Press J to jump to the feed. Press question mark to learn the rest of the keyboard shortcuts.

Buying An Electric Car Tips You Need Autotrader

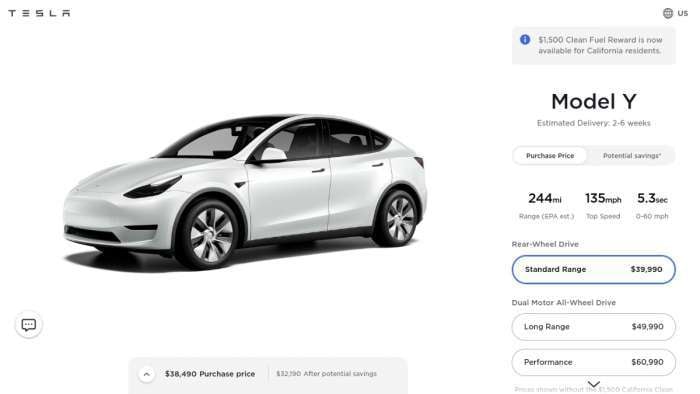

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Still Dominant But Electric Car Competition Heats Up Kelley Blue Book

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Latest On Tesla Ev Tax Credit June 2022

Tesla Opens Model 3 Configurator To Reservation Holders On The East Coast And Midwest Tesla New Tesla Tesla Model S

Tesla Moves Its Pricing Pawns While Positioning For The Big Electric Play

Tesla Model 3 Prices Go Up Federal Ev Rebate No Longer Applies The Car Guide

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Tesla Model Y Seats And Cargo Shown Range Nudged To 316 Miles

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Increases Model 3 And Model Y Prices In Canada Again Making The Entry Level Model 3 Ineligible For The Izev Rebate Update Drive Tesla

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Model 3 Tesla Model Tesla Car Tesla Motors

This Is Why We Think The Sr Model Y Will Soon Be 5 000 Cheaper In Canada Update Drive Tesla